Your first thought may be…

This is crazy!

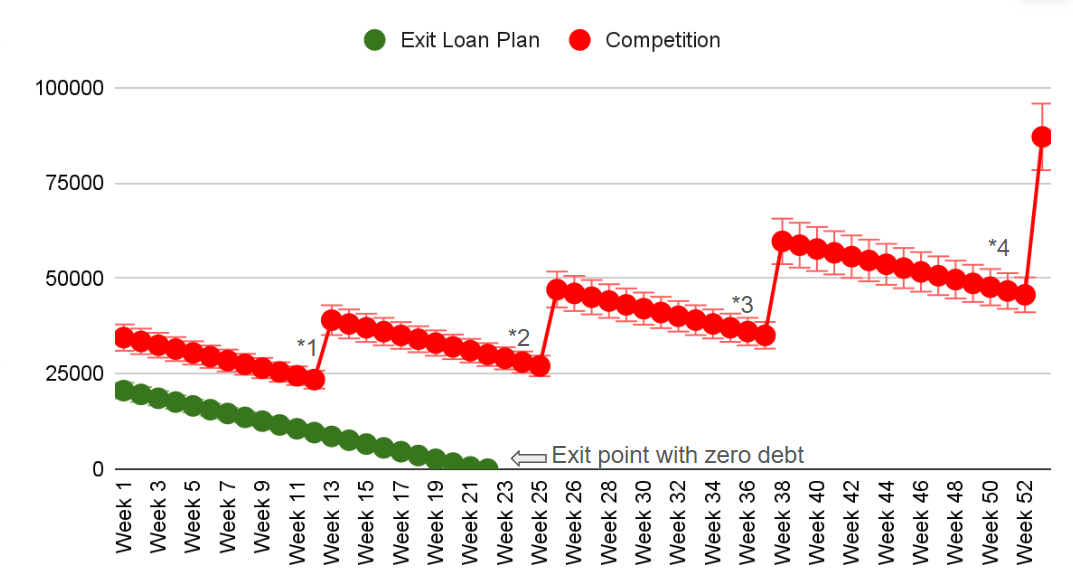

With the Exit Plan Loan, a $1,000 monthly payment can fully repay your loan in under 22 weeks. In contrast, similar payments toward competitors’ working capital loans for 52 weeks may result in repaying over four times the original borrowed amount.

No wonder you can’t get your

working capital loans paid off!

Comparison

What is causing the difference between Exit Plan Loan

Other Issues